Bank of America to Launch Expanded microSD Trial in Three Cities

Bank of America plans to launch an expanded trial of contactless microSD cards–enabling customers in Atlanta, New York and San Francisco to tap to pay with BlackBerry smartphones using both MasterCard PayPass and Visa payWave applications, a bank spokeswoman confirmed to NFC Times.

The trial, which is set to launch in late March, follows a microSD card trial the bank conducted last fall mostly among employees in New York City. Only Visa payWave was involved. That trial included use of Apple’s iPhone with a special attachment.

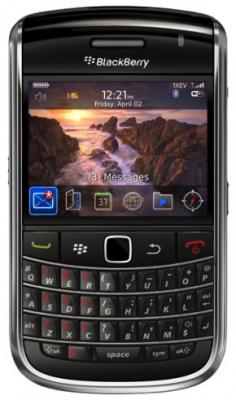

The new trial will involve six BlackBerry models, which will reportedly enable users to load up to four Bank of America debit and credit card accounts into a "Mobile Wallet."

The applications, Visa payWave for debit and PayPass for credit, will be stored on contactless microSD cards provided by U.S.-based DeviceFidelity.

It is believed to be the first microSD card trial involving PayPass. Visa had had an exclusive deal with DeviceFidelity to put payWave on the vendor’s miniature flash-memory cards. But that period of exclusivity has expired, DeviceFidelity CEO Deepak Jain confirmed to NFC Times, though he declined to discuss the Bank of America trial or his company’s work with particular payment card networks.

But a source with MasterCard confirmed to NFC Times that it is now working with the DeviceFidelity microSD cards. MasterCard had been using other NFC phone alternative devices, sometimes called bridge technologies, along with NFC phones.

One or more of the BlackBerry models–the Bold 9000, 9650 and 9700; Curve 8520 and 8530; and Tour 9630–likely will need a "Range Extender," a sticker which customers would affix to the inside back covers of their phones, giving the devices a range of 2 to 4 centimeters. DeviceFidelity’s Jain said the Range Extenders can be delivered preinstalled in replacement back covers.

Bank of America could distribute these replacement covers along with the microSDs to trial participants.

The bank has declined to say how many people will be involved in the roughly three-month trial. It was taking applications for the trial on its Web site, according to a report by mobile technology blogging and news site, BGR.

Bank of America is one of four major U.S. banks that have tested the contactless microSD cards. The others are JPMorgan Chase, Wells Fargo and U.S. Bancorp. But it is believed to be the first to expand on its initial trial. A successful trial this spring could lead to a rollout.

The big U.S. banks see microSDs as a way to launch contactless-mobile payment without waiting for the wide deployment of full NFC phones and without the need to work with mobile carriers and share revenue with them.

The banks are anxious to launch mobile payment because–among other reasons–they are under threat from new payments players. These include three major U.S. operators, AT&T, Verizon Wireless and T-Mobile USA, which have formed a joint venture and plan to launch their own payment brand, Isis, next year using NFC phones.

The banks could issue the microSDs to customers preloaded and personalized like conventional payment cards or with the applications downloaded over the air to the microSDs in the phones. Customers could manage their card accounts on the handset screens through apps on the phones. That is not possible with passive payment stickers, which a few banks in the United States and elsehwere have issued to their customers to attach to the backs of their phones.

Consumers can pay with the contactless microSD cards at the same point-of-sale terminals that accept contactless cards, now more than 100,000 locations in the United States.

But the microSDs have a much shorter range than contactless cards, and there has been some doubt that they could yield a consistent user experience when customers tap them on terminals to pay.

Visa, however, has certified some smartphone models for use with the cards, including two of the BlackBerrys planned by Bank of America for the new trial, the Bold 9650 and Tour 9630; along with the last three iPhone models; the Samsung Vibrant; Samsung Galaxy-S i9000; and more recently the Android-based Samsung Epic 4G and the Samsung Fascinate, Mesmerize and Showcase models.

Many or most of these models would not pass muster with Visa without the Range Extender, which DeviceFidelity said allows consumers to tap the back of the phones every time to pay, not the part of the phone where the microSD slot is located. Without the extra antenna, the read range might be only 2 millimeters or less, much too small to meet Visa’s or MasterCard's requirements.

The iPhone requires a special sleeve with a microSD card slot.